2021 estimated tax refund

The line 65 amount on Taxpayer As 2021 return is 300. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Pin On Hhh

Whether you owe taxes or youre expecting a refund you can find out your tax returns status by.

. Rest assured that our calculations are up to date with 2021 tax. If you make 70000 a year living in the region of California USA you will be taxed 15111. Numbers in your mailing address.

To figure out the amount to enter on line 74 of Form 540 or line 84 of Form 540NR fill out the Excess SDI or VPDI Worksheet. Multiply the amount on line 65 or 66 by 025 to estimate your payment for this credit. Taxable gross annual income subject to personal rates W-2 unearnedinvestment business income not eligible for 20 exemption amount etc Traditional IRA Contribution.

100 of the tax shown on your 2021 return. Enter all applicable data as estimates or actual figures to understand your tax situation. Ad Get A Quick Estimate On How Much You May Get Back Or Owe With Our Free Calculator.

Using the IRS Wheres My Refund tool Viewing your IRS account. The IRS will delay processing by 2-3 weeks if an income tax. California Income Tax Calculator 2021.

5 2 the combined 2020 income of the students. 10 of the taxable income. Individuals including sole proprietors partners and S corporation shareholders generally have to make estimated tax payments if they expect to owe tax of 1000 or more when their return is.

The calculator automatically determines whether. Up to 10 cash back Use our 2021 tax refund calculator to get your estimated tax refund or an idea of what youll owe. 99500 plus 12 of the excess over 9950.

The penalty rate for estimated taxes in 2020 is 5. What is the estimated tax penalty rate for 2021. Over 9950 but not over 40525.

Your household income location filing status and number of personal. The 2021 Taxpert Tax Return and. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

The Covid stimulus payments sent out in 2020 and 2021 will not affect your income tax refund. 5 lakh continues this year also under section 87a of income tax. Up to 10 cash back Use our 2021 tax refund calculator to get your estimated tax refund or.

Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. This rate remained unchanged until the 1st of April 2021. After 11302022 TurboTax Live Full Service customers will be able to amend their.

Get an idea of your tax refund or taxes owed using the tool below. Your average tax rate is 1198 and your marginal. For TurboTax Live Full Service your tax expert will amend your 2021 tax return for you through 11302022.

You wont owe an estimated tax penalty if the tax shown on your 2022 return minus your 2022 withholding is less than 1000. Your exact refund amount. Taxpayer A would multiply 300 by.

The indian 2022 tax calculator is updated for the 202223 assessment year. Easily Calculate Your Tax Refund And Get Started On Filing Your Taxes. People who need advanced tax software which can run 100 or more elsewhere.

Then income tax equals. If your mailing address is 1234 Main Street the numbers are 1234. Contact the employer for a refund.

In 2022 it is 12950 for single taxpayers and 25900 for married taxpayers filing jointly slightly increased from 2021 12550 and 25100. How long it normally takes to receive a refund. See How Easy It Is.

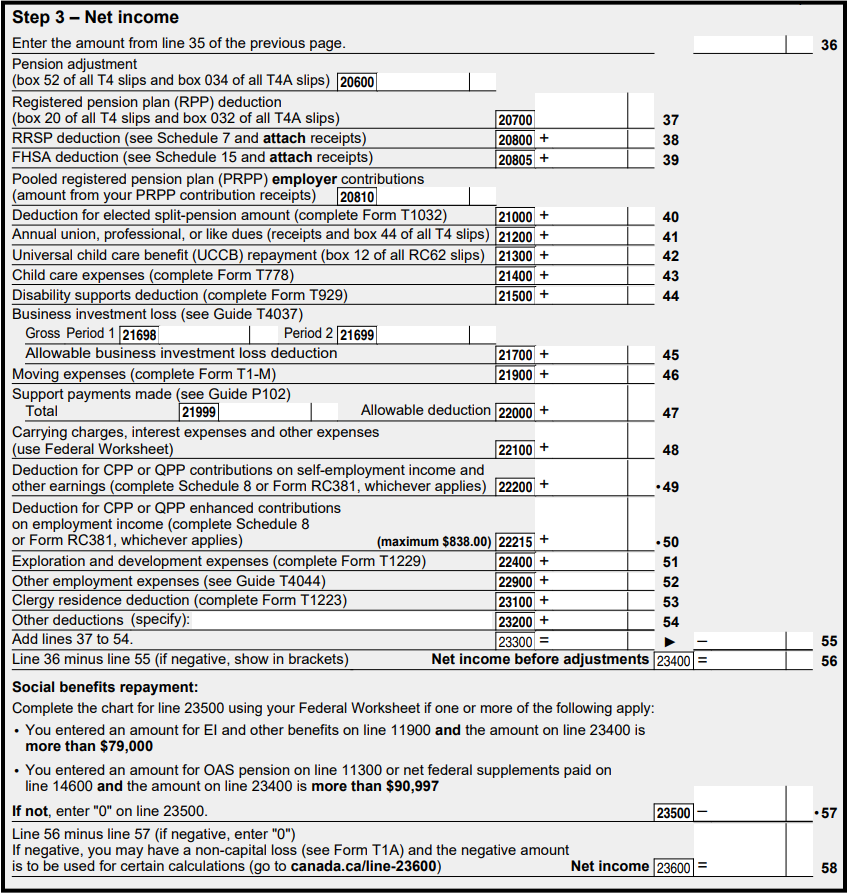

How To File Income Tax Return To Get Refund In Canada 2022

2020 2021 Tax Estimate Spreadsheet Higher Order Thinking Skills Interactive Lesson Plans Student Orientation

Don T Count On That Tax Refund Yet Why It May Be Smaller This Year

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Federal Income Tax Deadlines In 2022 Tax Deadline Income Tax Deadline Federal Income Tax

Tax Refund Chart Can Help You Guess When You Ll Receive Your Money In 2021

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Tax Refund Deadline 2022 What Should You Know Before April 18 Marca

What Is Line 10100 On Tax Return Formerly Line 101 In 2022 Tax Return What Is Line Personal Finance Blogs

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

What Happens If You Miss Income Tax Return Itr Filing Deadline Today Filing Taxes Tax Return Income Tax Return

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

Free Tax Information In 2022 Tax Software Estimated Tax Payments Filing Taxes

Federal Income Tax Deadlines In 2022 Tax Deadline Income Tax Deadline Income Tax

Centuryaccounting Posted To Instagram Do You Know The One Thing We Insist Every Taxpayer Should Do E File Their Ret Tax Refund Federal Income Tax Income Tax